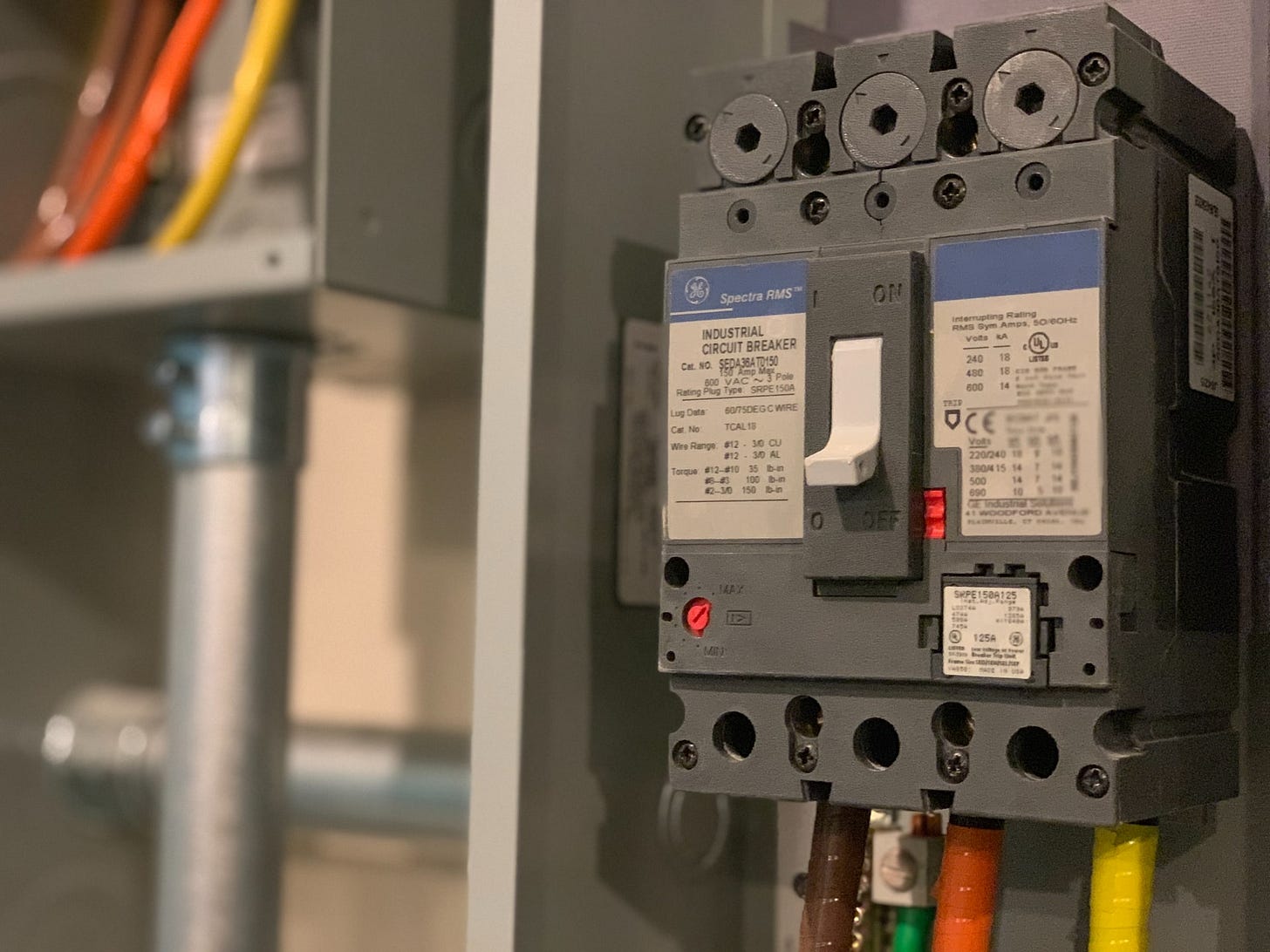

Photo by Troy Bridges on Unsplash

Hey there, and welcome to issue 024 of WTF is going on with the Economy?!

Before we get started, I have something to share with you.

Last week, we could do a socially-distanced presentation to a small group of people here in the office.

In it, we went over what to keep an eye on for the next coming months as 2020 (thankfully) draws to a close.

Here's the slide deck from the presentation. Check it out! The speaker notes cover (most) slides. Like it? Please share it with a friend!

Right, on to this week's issue.

What we're watching:

There's tons of stuff happening this week that we're all keeping an eye on. Here's what you should know:

Will there be more lockdowns in Europe? It seems that governments are hitting the panic button threatening more lockdowns (or, in the case of Madrid, somewhat following through with it). Despite the health threat, the economic reality is that we can't afford a repeat of the Spring. Governments are aware of this fact.

However, that doesn't mean that their words won't scare people. While that might work from a health perspective, scaring consumers won't help the economy recover. Let's see if there's a middle-ground found for the coming month that balances health concerns with economic ones.

Fishy Business on Brexit. Brexit is still happening, and as of right now, it's gearing up to be a hard one (although don't count out a last-minute deal to save the day). Right now, fishing rights between the EU and the UK are a significant sticking point. While it seems minor on the surface (sorry), the issue of fishing rights in the North Sea runs deep (sorry again).

In short, each country has territorial waters that belong to them. For fishing purposes though, EU members must share access with each other and respect bloc-wide quotas.

The UK wants more control of their territorial waters (which they have a lot of) and bilateral deals with the EU each year about how much they can fish.

We've seen this situation before. In fact, one of the main reasons why Norway isn't a part of the EU is due to their opposition to EU rules on fisheries. If we see a breakthrough here, Brexit will get softer, which will be good for the pan-European economy. Right now, we could really use some positive news.

What's Wirecard, and why was it in the news?

Over the past few months, you might have heard the name "Wirecard." You also probably wondered what that is and why it's in the news.

Here's what's happening.

Wirecard was a B2B financial technology (Fintech) company from Germany, focused on payments. You might not have seen them, but they were everywhere.

In addition to helping banks and merchants process payments, Wirecard helped Fintech companies offer banking products to consumers.

Prepaid debit cards were at the core of this offering, enabling startups like Revolut, Curve, and others to give their clients bank cards without having to register as a bank (seriously. Most 'neobanks' aren't actually banks. I'd be happy to explain that in a bit more detail. Email me and I'll fill you in!).

As you can imagine, the company was incredibly popular. By the middle of the last decade, the firm, based in Germany, went public.

With its shares entering the prestigious DAX 30 index of the largest publicly-traded German companies, its position as a European tech darling was in the books.

Until it wasn't.

In late June, Wirecard filed for insolvency in German courts.

Leading up to this event was a series of scandals -- one worse than the other -- revealing that Wirecard was not making the money it reported on its balance sheets and was actively forging financial statements.

When the dust settled, it became clear that years of mismanagement, laziness, and outright deception were the standard operating procedures at Wirecard.

Major auditors, including EY and KPMG, both missed or ignored the warning signs.

Now, 2 billion euros worth of Wirecard's cash purportedly in the Philippines isn't there (and allegedly never was).

Its former CFO is an international fugitive wanted on criminal charges for financial crimes in Germany.

What remains of the company is getting carved up and sold at auction.

And, while better now, its corporate customers were left wondering what the hell happened while scrambling to find an alternative.

Oops.

Why is this scandal so huge?

When it comes to tech conglomerates, Europe has been playing catch-up with the US for years. Having a company like Wirecard literally disappear overnight is a huge setback for a continent that needs to become more competitive with the rest of the world.

Further, Germany is the EU's biggest economy, with a reputation for diligence and a risk-based approach to financial affairs. Having a company on the DAX 30 fail due to years of fraud is hugely embarrassing.

The German government is now reconciling the outcome while trying to increase its capital markets while also preventing a repeat of the Wirecard scandal. To that end, the DAX 30 will become the DAX 40 in the coming months. The idea is that with a bigger index, there will be less pressure on its members to set unrealistic performance goals. Plus, diversification is always welcome by the investment community.

We'll see what becomes of it, but the saga continues to unfold in the financial news.

However, it's clear that whatever the outcome, the German stock market won't look the same as the global economy recovers.